CUHK

RMDA

M.Sc. in Risk Management Science and Data Analytics

OVERVIEW

INTRODUCTION

Risk management is an important subject in both the financial and public sectors. A successful risk management system incorporates expert knowledge from the fields of mathematics, statistics, actuarial science, finance, computing and engineering. This synergy of interdisciplinary knowledge distinguishes risk management from more traditional subjects.

The Risk Management Science programmes offered by the Department of Statistics at the Chinese University of Hong Kong have played leading roles in the development of the risk management discipline in Hong Kong. The highly successful Master of Science Programme in Risk Management Science was launched in 2003 and has been well received by the public. The programme was renamed M.Sc. in Risk Management Science and Data Analytics in 2021-22 to reflect the new elements of the evolving field of data analytics. Graduates are equipped with state-of-the-art risk management expertise that will allow them to play a leading role in the industry.

FEATURES

Full-time (1 year)Part-time (2 years)

Each course consists of a three-hour lecture each week

Weekday evenings & Saturdays at CUHK in Shatin

The M.Sc. in Risk Management Science and Data Analytics programme is an Academic Partner of the Global Association of Risk Professionals (GARP).

GARP is very pleased to announce the addition of The Chinese University of Hong Kong to the GARP Partnership for Risk Education. The M.Sc. in Risk Management Science offered by the Faculty of Science is a highly rigorous program. The curriculum offered is interdisciplinary in its approach, and provides its students a solid grounding in mathematics, finance, statistics etc., ensuring they will be well positioned to pursue the FRM designation and to assume strategic roles within the global risk management profession.

FRM SCHOLARSHIP

The programme is an Academic Partner of the Global Association of Risk Professionals (GARP). FRM scholarships will be awarded to selected full-time students. The exam registration fee for FRM Part I Exam will be waived.

COURSE EXEMPTION

Students who passed FRM Part 1 Exam are eligible for exemption of core course RMSC5002 Principles of Risk Management.

CURRICULUM

MODE OF STUDY

PART-TIME MODE

The normative study period of part-time study mode is two years. Students should satisfy the following requirements in order to obtain the degree.

1ST YEAR

Core courses: 6 credits;Elective courses: 6 credits

2ND YEAR

Core courses: 6 credits;Elective courses: 6 credits

TOTAL24 CREDITS

Note: Students are required to complete a minimum of 24 credits in order to graduate.

SUGGESTED STUDY PLAN

1st Term of Year 1: RMSC5002, RMSC5101, RMSC6003

2nd Term of Year 1: RMSC5004, RMSC5102, STAT6108

1st Term of Year 2: RMSC5003, RMSC6002, STAT6104, STAT6105

2nd Term of Year 2: RMSC5001, RMSC6001, RMSC6007

Note: Students should take at least 2 elective courses at RMSC6000 level or above, or at STAT5000 level or above.

CORE COURSES

RMSC 5001

RMSC 5001ADVANCED STATISTICAL THEORY IN RISK MANAGEMENT

This course discusses modern applications of advanced statistical methods in finance. Methods include Monte Carlo simulation, EWMA and GARCH model for estimating volatilities and correlations, calculation of Value at Risk using different approaches, data mining methods including Principal component analysis, Logistic regression, Multinomial logit, Linear Discriminant analysis, Classification Tree and Artificial Neural Network.

RMSC 5002

RMSC 5002PRINCIPLES OF RISK MANAGEMENT

This course provides students with fundamental concepts of risk and risk management. It further introduces risk management tools used in financial products. Topics include market risk, credit risk and integrated risk management.

RMSC 5003

RMSC 5003RISK MEASURES

Risk measurement and quantification are the fundamentals of risk management procedures. This course discusses various types of risk measures but mainly focuses on the methodologies of calculating Value-at-Risk (VaR) such as historical simulation, parametric VaR, delta-gamma approximation and Monte-Carlo simulation. The uses of VaR in risk management are also addressed. Topics include portfolio risk management, asset allocation and measuring the performance of portfolio managers.

RMSC 5004

RMSC 5004CASES FOR RISK MANAGEMENT IN PRACTICE

Students need to present and discuss literatures assigned to them by the instructor on topics of current interest in financial risk management.

ELECTIVE COURSES

RMSC 5101

RMSC 5101STATISTICAL METHODS IN RISK MANAGEMENT AND FINANCE

This course is designed to introduce the current developments in risk management in the financial markets. Risk management ideas associated with three general important areas in finance will be discussed: asset management, derivative pricing, and fixed income models. Emphasis will be placed on the statistical modelling aspects on some of the commonly used models in these areas.

RMSC 5102

RMSC 5102SIMULATION TECHNIQUES IN RISK MANAGEMENT AND FINANCE

This course starts with presenting standard topics in simulation including random variable generations, variance reduction methods and statistical analysis of simulation outputs. The course then reviews the applications of these methods to derivative security pricing. Topics addressed include importance sampling, martingale control variables, stratification and the estimation of derivatives. Additional topics include the use of low discrepancy sequence (quasi-random numbers), pricing American options and scenario simulation for risk management.

RMSC 6001

RMSC 6001INTEREST RATES AND FIXED INCOMES RISK MANAGEMENT

Fixed income securities are highly sensitive to the fluctuation of interest rates. Thus interest rate modelling becomes crucial for pricing and managing fixed income securities. This course introduces various types of fixed income securities and interest rate models. It covers the celebrated Heath-Jarrow-Morton (HJM) model as well as some term-structure models including Ho-Lee, Hull-White and the CIR models.

RMSC 6002

RMSC 6002CREDIT RISK MANAGEMENT

The Credit Crisis of 2007 devastated the global financial industry and demonstrated that, despite unprecedented financial sophistication, proper credit risk management is vital for the good health of any financial institution. In this course, we will cover the cat-and-mouse history of regulation of credit, taking us to the present day. Along the way, we cover various attempts at modeling and quantifying credit risk, which will lead us through topics like VaR, copulas, credit derivatives, different credit risk methodologies (e.g. Credit Risk Plus, CreditMetrics) and much else besides. We will also discuss various case histories of financial institutions failing due to poor credit risk management.

RMSC 6003

RMSC 6003RISK MANAGEMENT IN FINANCIAL INSTITUTIONS

The course aims to discuss how risk management is applied in the banking sector.

RMSC 6004

RMSC 6004SPECIAL TOPICS IN RISK MANAGEMENT

The course aims at discussing recent advances in risk management.

RMSC 6005

RMSC 6005SPECIAL TOPICS IN QUANTITATIVE FINANCE

The course aims at discussing recent advances in quantitative finance.

RMSC 6006

RMSC 6006PORTFOLIO THEORY WITH RISK MANAGEMENT PERSPECTIVE

The course introduces the general theory of financial portfolio based on utility theory. Non-arbitrage pricing theory based on the idea of risk management will be applied. Selected topics include utility functions, risk aversion, the St Petersburg paradox, dynamic asset pricing, forecast and valuation, portfolio optimisation under budget constraints, wealth consumption, and growth versus income.

RMSC 6007

RMSC 6007RISK AND FINANCIAL DATA ANALYTICS WITH PYTHON

The aim of the course is to provide students with a broad understanding of the principles and techniques of Python coding for finance applications on Jupyter notebook and/or other programming interfaces. Following an introduction to the basics of Python, the course is further divided into two main sections. The first part covers the fundamentals of data reduction and modelling applied specifically to financial data with Python libraries. Techniques for derivative pricing, risk measures estimation with Python are also discussed. The second part emphasises on several specific examples of applying state-of-the-art machine learning tools for various modelling/ analyses. Understanding the problems covered in the course will be important to students pursing a career in a rapidly expanding technology-intensive field of finance and risk management.

STAT 5103

STAT 5103HIGH-DIMENSIONAL DATA ANALYSIS

Beginning with an introduction to the basic knowledge in multivariate and high-dimensional data analysis, including multinormal distribution, descriptive statistics, and graphical displays, this course focuses on the dimensionality reduction methods, which are commonly used in high-dimensional data analysis. Selected topics include principal component analysis, factor analysis and canonical correlation analysis.

STAT 6104

STAT 6104FINANCIAL TIME SERIES

This course deals with the methodology and applications of business and financial time series. Topics include statistical tools useful in analysing time series, models for stationary and non-stationary time series, seasonality, forecasting techniques, heteroskedasticity, ARCH and GARCH models, and multivariate time series.

STAT 6105

STAT 6105BASIC ACTUARIAL PRINCIPLES AND THEIR APPLICATIONS

This course introduces the basic actuarial principles applicable to a variety of financial security systems. Focus will be on topics related to life insurances and annuities. It also develops students’ understanding of the purpose of these systems, and the design and development of financial security products. Topics include theory of interest, survival distribution and life tables, life insurance, life annuities, and benefit premiums.

STAT 6107

STAT 6107SELECTED TOPICS IN DATA SCIENCE AND BUSINESS STATISTICS

Recent topics on data science and business statistics are selected for discussion.

STAT 6108

STAT 6108OFFICIAL STATISTICS AND STRUCTURAL EQUATION MODELLING

The course introduces the basic principles, concepts and methodologies of official statistics and business statistics. The course is divided into two parts, “Official Statistics” and “Structural Equation Modelling”.

STAT 6204

STAT 6204ADVANCED TIME SERIES

This course introduces the advanced methodology in time series analysis and its applications to finance. The use of statistical packages R will be demonstrated.

OTHER UNIVERSITY REQUIREMENTS

(a) Students much fulfill the Term Assessment Requirement of the Graduate School. For details, please refer to Section 13.0 Unsatisfactory Performance and Discontinuation of Studies of the General Regulations Governing Postgraduate Studies which can be accessed from the Graduate School Homepage: http://www.gs.cuhk.edu.hk/.

(b) A student must achieve a cumulative grade point average (GPA) of at least 2.0 in order to graduate.

FULL-TIME MODE

The normative study period of full-time mode is one year. Students should satisfy the following requirements in order to obtain the degree.

1ST SEMESTER

Core courses: 6 credits;Elective courses: 6 credits

2ND SEMESTER

Core courses: 6 credits;Elective courses: 6 credits

TOTAL24 CREDITS

Note: Students are required to complete a minimum of 24 credits in order to graduate.

SUGGESTED STUDY PLAN

1st Term of Year 1: RMSC5002, RMSC5003, RMSC5101, RMSC6002, RMSC6003, STAT6104, STAT6105

2nd Term of Year 1: RMSC5001, RMSC5004, RMSC5102, RMSC6001, RMSC6007, RMSC6008, STAT6108

Note: Students should take at least 2 elective courses at RMSC6000 level or above, or at STAT5000 level or above.

CORE COURSES

RMSC 5001

RMSC 5001ADVANCED STATISTICAL THEORY IN RISK MANAGEMENT

This course discusses modern applications of advanced statistical methods in finance. Methods include Monte Carlo simulation, EWMA and GARCH model for estimating volatilities and correlations, calculation of Value at Risk using different approaches, data mining methods including Principal component analysis, Logistic regression, Multinomial logit, Linear Discriminant analysis, Classification Tree and Artificial Neural Network.

RMSC 5002

RMSC 5002PRINCIPLES OF RISK MANAGEMENT

This course provides students with fundamental concepts of risk and risk management. It further introduces risk management tools used in financial products. Topics include market risk, credit risk and integrated risk management.

RMSC 5003

RMSC 5003RISK MEASURES

Risk measurement and quantification are the fundamentals of risk management procedures. This course discusses various types of risk measures but mainly focuses on the methodologies of calculating Value-at-Risk (VaR) such as historical simulation, parametric VaR, delta-gamma approximation and Monte-Carlo simulation. The uses of VaR in risk management are also addressed. Topics include portfolio risk management, asset allocation and measuring the performance of portfolio managers.

RMSC 5004

RMSC 5004SPECIAL TOPICS IN RISK MANAGEMENT

Students need to present and discuss literatures assigned to them by the instructor on topics of current interest in financial risk management.

ELECTIVE COURSES

RMSC 5101

RMSC 5101STATISTICAL METHODS IN RISK MANAGEMENT AND FINANCE

This course is designed to introduce the current developments in risk management in the financial markets. Risk management ideas associated with three general important areas in finance will be discussed: asset management, derivative pricing, and fixed income models. Emphasis will be placed on the statistical modelling aspects on some of the commonly used models in these areas.

RMSC 5102

RMSC 5102SIMULATION TECHNIQUES IN RISK MANAGEMENT AND FINANCE

This course starts with presenting standard topics in simulation including random variable generations, variance reduction methods and statistical analysis of simulation outputs. The course then reviews the applications of these methods to derivative security pricing. Topics addressed include importance sampling, martingale control variables, stratification and the estimation of derivatives. Additional topics include the use of low discrepancy sequence (quasi-random numbers), pricing American options and scenario simulation for risk management.

RMSC 6001

RMSC 6001INTEREST RATES AND FIXED INCOMES RISK MANAGEMENT

Fixed income securities are highly sensitive to the fluctuation of interest rates. Thus interest rate modeling becomes crucial for pricing and managing fixed income securities. This course introduces various types of fixed income securities and interest rate models. It covers the celebrated Heath-Jarrow-Morton (HJM) model as well as some term-structure models including Ho-Lee, Hull-White and the CIR models.

RMSC 6002

RMSC 6002CREDIT RISK MANAGEMENT

The Credit Crisis of 2007 devastated the global financial industry and demonstrated that, despite unprecedented financial sophistication, proper credit risk management is vital for the good health of any financial institution. In this course, we will cover the cat-and-mouse history of regulation of credit, taking us to the present day. Along the way, we cover various attempts at modeling and quantifying credit risk, which will lead us through topics like VaR, copulas, credit derivatives, different credit risk methodologies (e.g. Credit Risk Plus, CreditMetrics) and much else besides. We will also discuss various case histories of financial institutions failing due to poor credit risk management.

RMSC 6003

RMSC 6003RISK MANAGEMENT IN FINANCIAL INSTITUTIONS

The course aims to discuss how risk management is applied in the banking sector.

RMSC 6004

RMSC 6004SPECIAL TOPICS IN RISK MANAGEMENT

The course aims at discussing recent advances in risk management.

RMSC 6005

RMSC 6005SPECIAL TOPICS IN QUANTITATIVE FINANCE

The course aims at discussing recent advances in quantitative finance.

RMSC 6006

RMSC 6006PORTFOLIO THEORY WITH RISK MANAGEMENT PERSPECTIVE

The course introduces the general theory of financial portfolio based on utility theory. Non-arbitrage pricing theory based on the idea of risk management will be applied. Selected topics include utility functions, risk aversion, the St Petersburg paradox, dynamic asset pricing, forecast and valuation, portfolio optimization under budget constraints, wealth consumption, and growth versus income.

RMSC 6007

RMSC 6007RISK AND FINANCIAL DATA ANALYTICS WITH PYTHON

The aim of the course is to provide students with a broad understanding of the principles and techniques of Python coding for finance applications on Jupyter notebook and/or other programming interfaces. Following an introduction to the basics of Python, the course is further divided into two main sections. The first part covers the fundamentals of data reduction and modelling applied specifically to financial data with Python libraries. Techniques for derivative pricing, risk measures estimation with Python are also discussed. The second part emphasises on several specific examples of applying state-of-the-art machine learning tools for various modelling/ analyses. Understanding the problems covered in the course will be important to students pursing a career in a rapidly expanding technology-intensive field of finance and risk management.

RMSC 6008

RMSC 6008PRACTICUM

The course serves to provide a bridge between the classroom and the real business world. Students will be required to complete a project assigned by a company or an organization on a part-time basis. Each student will undertake a project under the joint supervision of an instructor and a member of the company or organization. Students will be required to give a final project presentation and submit a written report on which their assessment will be based.

STAT 5103

STAT 5103HIGH-DIMENSIONAL DATA ANALYSIS

Beginning with an introduction to the basic knowledge in multivariate and high-dimensional data analysis, including multinormal distribution, descriptive statistics, and graphical displays, this course focuses on the dimensionality reduction methods, which are commonly used in high-dimensional data analysis. Selected topics include principal component analysis, factor analysis and canonical correlation analysis.

STAT 6104

STAT 6104FINANCIAL TIME SERIES

This course deals with the methodology and applications of business and financial time series. Topics include statistical tools useful in analysing time series, models for stationary and non-stationary time series, seasonality, forecasting techniques, heteroskedasticity, ARCH and GARCH models, and multivariate time series.

STAT 6105

STAT 6105BASIC ACTUARIAL PRINCIPLES AND THEIR APPLICATIONS

This course introduces the basic actuarial principles applicable to a variety of financial security systems. Focus will be on topics related to life insurances and annuities. It also develops students’ understanding of the purpose of these systems, and the design and development of financial security products. Topics include theory of interest, survival distribution and life tables, life insurance, life annuities, and benefit premiums.

STAT 6107

STAT 6107SELECTED TOPICS ON DATA SCIENCE AND BUSINESS STATISTICS

Recent topics on data science and business statistics are selected for discussion.

STAT 6108

STAT 6108OFFICIAL STATISTICS AND STRUCTURAL EQUATION MODELLING

The course introduces the basic principles, concepts and methodologies of official statistics and business statistics. The course is divided into two parts, “Official Statistics” and “Structural Equation Modelling”.

STAT 6204

STAT 6204 ADVANCED TIME SERIES

This course introduces the advanced methodology in time series analysis and its applications to finance. The use of statistical packages R will be demonstrated.

OTHER UNIVERSITY REQUIREMENTS

(a) Students much fulfill the Term Assessment Requirement of the Graduate School. For details, please refer to Section 13.0 Unsatisfactory Performance and Discontinuation of Studies of the General Regulations Governing Postgraduate Studies which can be accessed from the Graduate School Homepage: http://www.gs.cuhk.edu.hk/.

(b) A student must achieve a cumulative grade point average (GPA) of at least 2.0 in order to graduate.

ADMISSIONS

PROCEDURE

Applicants can submit online applications at Graduate School webpage: https://www.gradsch.cuhk.edu.hk/OnlineApp/login_email.aspx .

Scanned copies of the supporting documents should be uploaded to the Online Application System for Postgraduate Programmes. Official transcripts and hard copies of supporting documents are NOT required at the application stage. For the list of required supporting documents, please refer to Graduate School website https://www.gs.cuhk.edu.hk/admissions/admissions/documents-required .

APPLICATION TIMELINE

The application deadline for 2025/26 admission

PRIORITY ROUND

31 Dec 2024

FINAL ROUND

28 Feb 2025

Applications will be processed on a rolling basis until all places have been filled. Early applications are strongly encouraged.

TUITION FEE

The tuition fee for 2025/26 admission:

Part-time Mode: HKD 90,000 per year

Full-time Mode: HKD 187,000 per year

CONTINUING EDUCATION FUND (CEF)

RMSC5003 Risk Measures

CEF Course Code 33Z117715

RMSC5102 Simulation Techniques in Risk Management and Finance

CEF Course Code 33Z124703

These two courses have been included in the list of reimbursable courses under the Continuing Education Fund.

The mother programme (Master of Science in Risk Management Science and Data Analytics) of these courses is recognized under the Qualifications Framework (QF Level 6).

ADMISSION REQUIREMENTS

To be considered as a qualified applicant, one should:

- hold a Bachelor’s degree with Second Honours Class or above in Business, Science, Finance, Economics, Engineering or related disciplines; and

- fulfil the University’s minimum English language requirements for admission (more information is available on the Graduate School website at https://www.gs.cuhk.edu.hk/admissions/admissions/requirements); and

- preferably possess knowledge of Business, Economics and/or Finance though not compulsory.

PROGRAMME LEAFLET

EVENTS & SHARING

Annual Dinner and Award Presentation Ceremony

Annual Dinner 2024

Annual Dinner 2023

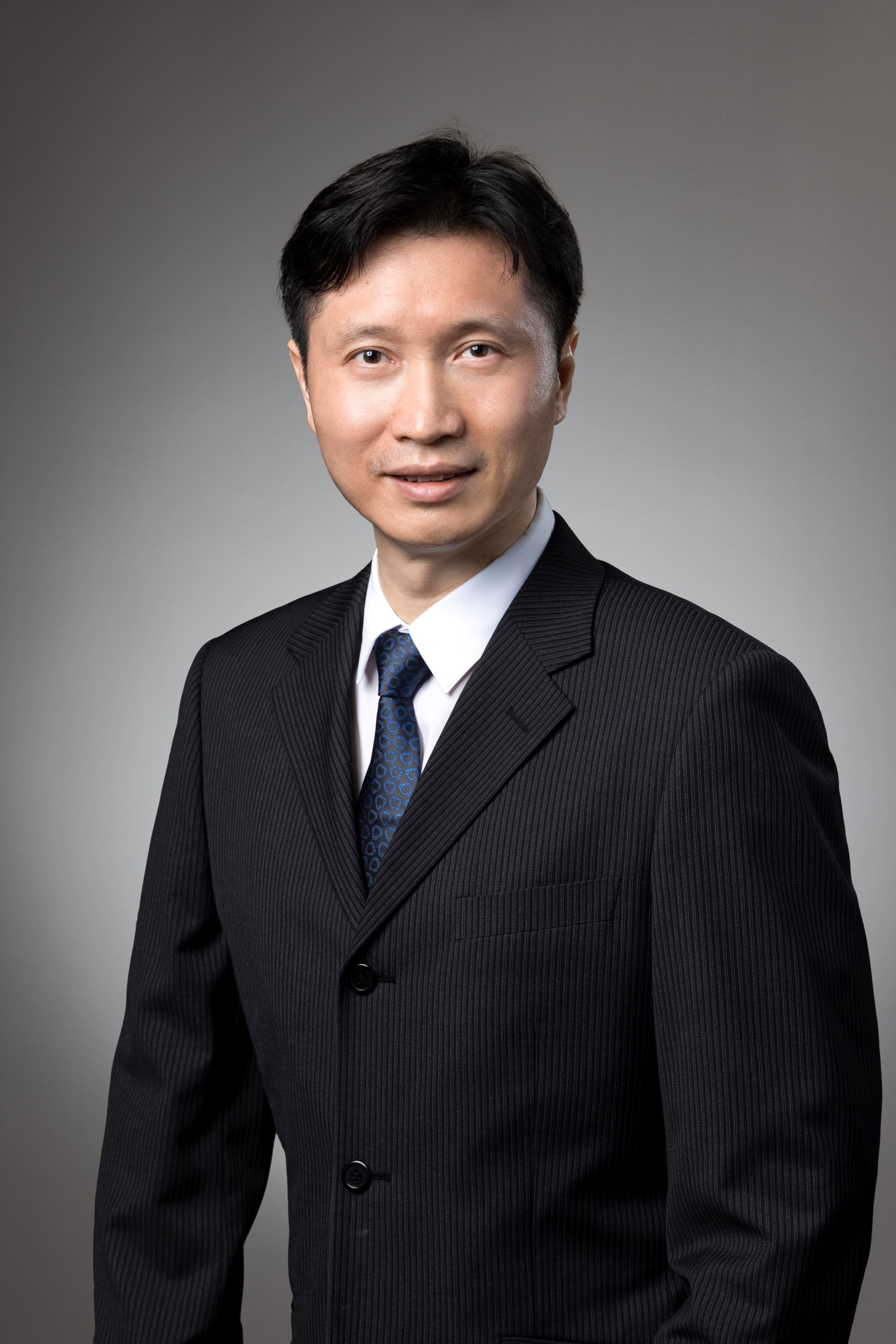

Dr Wong Tat Wing

Dr Wong is currently the Director of the MSc RMDA programme. He holds the position of Lecturer at the Department of Statistics, The Chinese University of Hong Kong (CUHK). Dr Wong has earned professional designations as an Associate of the Society of Actuaries and a Financial Risk Manager (FRM). He is also a Certified Instructor and University Ambassador at the NVIDIA Deep Learning Institute, generating awareness of the use of GPU technologies in accelerating machine learning tasks.

Courses taught by Dr Wong (2024/25):

RMSC5003 – Risk Measures

RMSC6008 – Practicum

Professor Wong Hoi Ying

Professor Wong is a Professor of Statistics, an Outstanding Fellow of the Faculty of Science, and an Associate Dean of Science (Student Affairs) at CUHK. His administrative experience includes being a founding Co-director of the BSc in Quantitative Finance and Risk Management Science programme, which is a flagship undergraduate programme of CUHK, and the Director of the MSc in Risk Management Science from 2013 to 2019. His research focuses on mathematical finance, actuarial science, FinTech, and machine learning. He has published over 100 articles in journals, including Mathematical Finance, Finance and Stochastics, Quantitative Finance, Journal of Banking and Finance, and others in the fields of applied mathematics and operations research. He has consulting experience with the Hong Kong Monetary Authority, commercial banks, and FinTech companies.

Course taught by Prof. Wong (2024/25):

RMSC6001 – Interest Rates and Fixed Income Risk Management

Professor Zhang Jiacheng

Professor Jiacheng Zhang is an Assistant Professor in the Department of Statistics at CUHK. Previously, he served as a postdoctoral researcher in the Industrial Engineering and Operations Research Department at the University of California, Berkeley, where he was advised by Professor Xin Guo. He obtained his Ph.D. in the Department of Operations Research and Financial Engineering at Princeton University in 2021, under the supervision of Professor Daniel Lacker and Professor Mykhaylo Shkolnikov. Prior to these positions, he received his bachelor’s degree in Mathematics from Tsinghua University in 2016.

His research focus lies in the theory of probability and stochastic optimization. In recent years, he has worked on stochastic partial differential equations, particularly McKean-Vlasov type equations, as well as partial differential equations, mathematical finance—including stochastic portfolio theory and stochastic volatility modeling.

Course taught by Prof. Zhang (2024/25):

RMSC5102 – Simulation Techniques in Risk Management and Finance

Dr John Alexander Wright

Dr Wright is a Senior Lecturer at the Department of Statistics, CUHK. His research interests lie in applied probability, especially financial mathematics. With over a decade of teaching under his belt, as well as several public outreach events for STEM subjects, he is an experienced educator who is keen to promote statistics and risk management to a wider audience. He has earned professional designations as an FRM and a Professional Risk Manager. In his spare time, he grows his moustache.

Courses (co-)taught by Dr Wright (2024/25):

RMSC6002 – Credit Risk Management

CRIC9999 – Advanced Cricket Studies

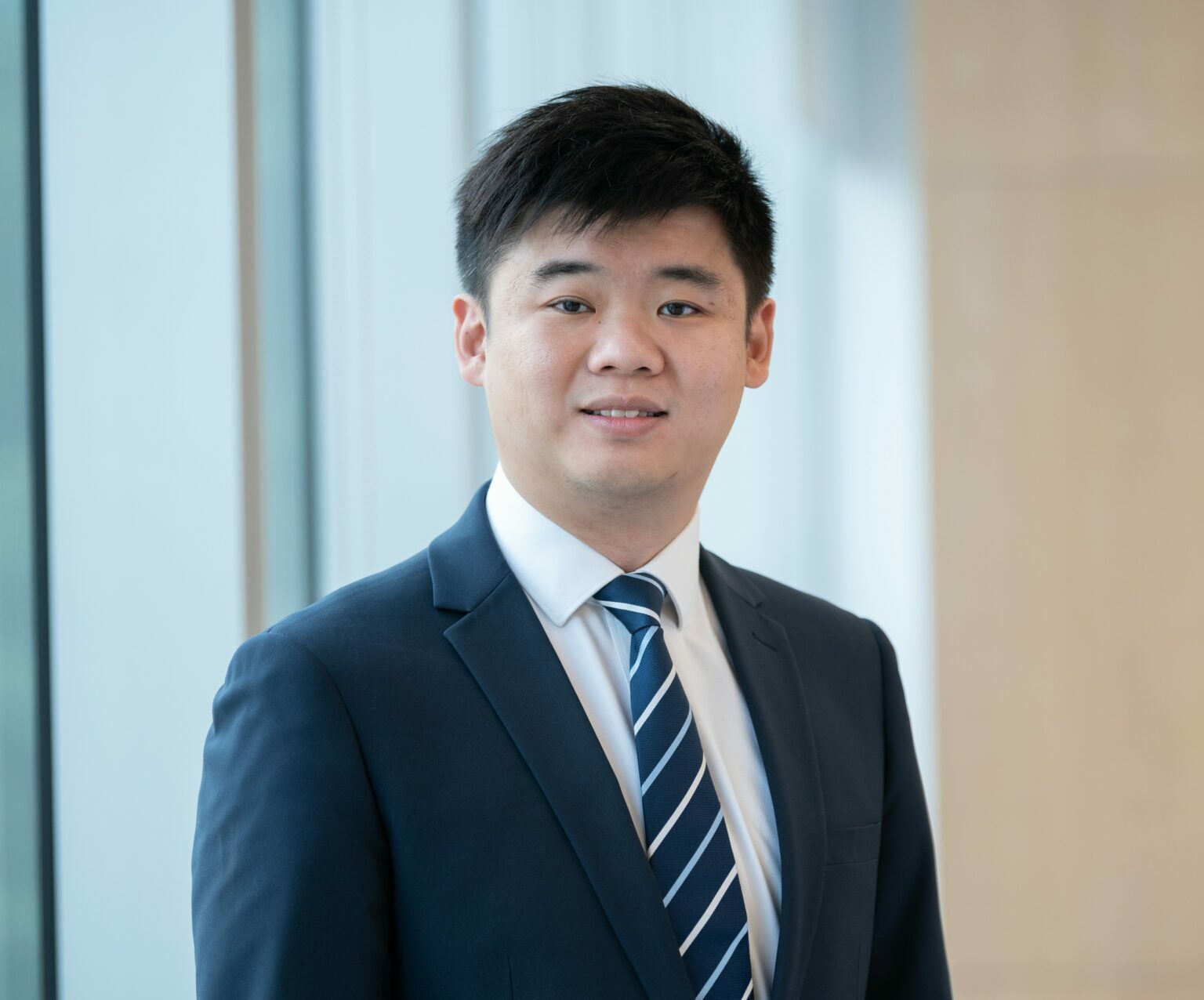

Dr Cheung King Chau

Dr Cheung is currently the Deputy Director of the MSc RMDA programme. He holds the position of Lecturer at the Department of Statistics, CUHK. His research interests are in network and financial data and portfolio management. He also holds certificates in machine learning, NLP, and computer vision.

Courses taught by Dr Cheung (2024/25):

RMSC5002 – Principles of Risk Management

Professor Yau Chun Yip

Professor Yau is currently a Professor at CUHK’s Department of Statistics, and has been the programme director of the BSc in Risk Management Science since 2014.

His research interests include financial time series, change-point analysis, and extreme value theory.

He has published over 50 papers in leading statistics journals, including Annals of Statistics, Biometrika, Journal of the Royal Statistical Society (Series B), and Journal of the American Statistical Association.

Courses (co-)taught by Prof. Yau (2024/25):

RMSC5101 – Statistical Methods in Finance and Risk Management

STAT6104 – Financial Time Series

Jeff Yu (class of 2023)

Pilot at Cathay Pacific

My name is Jeff, and I am a pilot at Cathay Pacific Airways. During my time off as a pilot when the world was grappling with the challenges of the COVID pandemic, I found myself yearning for something beyond the skies. Driven by an insatiable curiosity for mathematics, I decided to embark on a journey of knowledge and enrolled on the Master’s course Risk Management and Data Analytics at The Chinese University of Hong Kong.

Throughout the course, I encountered some truly impressive disciplines that left a profound impact on both my personal and professional life. The study of asset price modelling exposed me to simulation techniques and stochastic calculus, providing me with a unique perspective on risk and financial markets. This newfound insight has influenced my approach to personal investments, allowing me to make more strategic decisions based on the mathematical foundations instilled by the course.

Additionally, the programme gave me the opportunity to explore the fascinating world of machine learning, covering topics from decision tree models to artificial neural networks. This exposure not only piqued my curiosity but also laid a solid foundation for my future research in the field.

Beyond academic achievements, what truly made this experience enjoyable was the dedication of the teaching staff in the Statistics department. The support and guidance of the course coordinator, Dr TW Wong, and Professor Tony Sit were invaluable. They created a conducive learning environment that significantly impacted my academic performance and intellectual growth.

I am immensely grateful for my enriching experience at The Chinese University of Hong Kong. Not only did I gain valuable knowledge, but I also made lasting friendships. The camaraderie among students added an extra layer of joy to my time on the programme.

In conclusion, my journey through the MSc RMDA programme has been truly rewarding. I want to thank CUHK for providing me with the opportunity to explore my passion for mathematics and data analytics during the COVID period. It has been an honour to be part of this esteemed institution.

Elaine Kwong (class of 2023)

Operational Risk Management Specialist at an international bank

Pursuing an MSc in Risk Management Science and Data Analytics was a life-changing decision that I have no regrets about. The programme provides a small-class teaching environment that not only strengthens the connection between classmates but also fosters teacher–student relationships. Interacting with like-minded people to exchange ideas broadens our horizons and solidifies our risk management mindset. Without enrolling in a Master’s degree programme, I wouldn’t have had the chance to take a leap in my career and switch to the risk management field. It has pushed me to step out of my comfort zone, and the intrinsic value of the RMDA has greatly exceeded my expectations. I am so glad to be a part of this family.

Career Support

The programme provides students with a range of career services such as workshops on CV writing and interview skills, career talks and company visits to support their career development.

Workshop on Interview Skills and Assessment Centre

CV Writing Workshop and Individual CV Editing

Workshop on Landing a Management Trainee Offer

Career Talk by Census and Statistics Department, HKSAR Government

Career Talk on Cryptocurrency

Loo Long Hui (class of 2022)

Director, Risk Consulting, KPMG Advisory (HK) Limited

The programme brings together course participants from various disciplines, ranging from risk management practitioners and data and information technology specialists to finance professionals and academics. This provides a unique opportunity to exchange ideas and individual experiences while further exploring risk assessment concepts and methodologies. The delivery format of the course encourages debates on various topics through open-floor Q&A on group projects and sharing different perspectives from fellow participants and industry risk management representatives, providing practical examples of linking academic theory to actual implementation. The constantly evolving curriculum also motivates participants to keep abreast with the latest regulatory and risk management developments, which is invaluable throughout our professional careers.

Juan Lago, Guest Lecturer

Managing Director, Chief Representative Asia-Pacific at Banco Security

Mr. Lago teaches Risk Management in Financial Institutions, a course aimed at delving into how risk is managed in the banking sector, as well as gaining a general understanding of the industry. He has 18 years of experience in finance in Madrid, New York, Chile, and Hong Kong, and holds a master’s degree in industrial engineering from ICAI (Spain) and an MBA from INSEAD (France).

Courses (co-)taught by Mr. Lago (2024/25):

RMSC 6003 – Risk Management in Financial Institutions

Jason Chiu (class of 2019)

Fitch Ratings

What I liked most about the MSc in RMDA was its balance of theoretical and practical learning. We worked on an asset allocation project under the guidance of a seasoned portfolio manager, and experienced traders and risk managers shared their insights into the industry. We also attended programming workshops, which were very useful for my coursework and my career development. The programme provides a comprehensive range of courses, from required theoretical courses on stochastic calculus and simulation to topic-specific elective courses on market risk, credit risk and operational risk. I believe that the programme is both well structured and flexible. It offers students up-to-date information, with interesting new topics regularly added to the syllabus.

I had worked in the financial industry before enrolling in this programme. One of my biggest takeaways from the programme was a statistical way of thinking. Over two years of practice, I gradually honed my skills in analysing data and incorporating risk and uncertainty into decision making. I have found these two skills very helpful in my career.

Dr Joaquin Calvo, Guest Lecturer

Dr. Calvo teaches Risk Management in Financial Institutions. He has more than 20 years of experience in the financial industry, gained through his work in consulting at firms such as Oliver Wyman, Accenture, Deloitte, and EY, as well as collaboration with major financial institutions in the APAC region (Hong Kong, Singapore, Japan), Europe (Spain, UK, Germany, Portugal), and the Americas (US, Brazil). He also served as Head of Market Risk and Liquidity at a bank in Hong Kong.

Courses (co-)taught by Dr Calvo (2024/25):

RMSC 6003 – Risk Management in Financial Institutions

Franco Leung, Guest Lecturer

Director, Market Outreach, S & P Global Ratings

It is my honour to teach students in the MSc in Risk Management Science and Data Analytics (RMDA) programme at CUHK and share my over 20 years of experience in credit analysis, corporate rating and research, corporate treasury, fixed income markets, risk governance and portfolio risk management.

The RMDA programme offers dynamic, diverse and applicable courses to prepare students from all walks of life to contribute to society and advance their careers. It is current in terms of the market, including AI and machine learning in Fintech and common risk management tools used in corporates and the financial industry in general. The skills and knowledge that the students acquire from this programme are therefore very helpful in the rapidly evolving financial sector and the fast-changing world. Students not only learn and understand a wide range of risks and their associated quantifications but also learn how to manage and take measured risks. I believe they are better equipped to manage various international business cycles over the long-term.

The RMDA students I interacted with are talented, motivated and diligent individuals who constantly strive to learn and apply what they have learned in the real world. I could see from the project-based course assignments that they have great eagerness to learn, abundant teamwork spirit, good judgment and analytical skills. I am also pleased to know that they could secure their desired careers after graduation, with encouraging stories such as changing career paths in great ways, advancing their careers in existing jobs, and entering the workforce from academic lives. I am proud to hear what they have achieved and look forward to hearing more great stories from graduates in this programme.

Terrence Ho, Guest Lecturer

If you ever want to achieve your dream, you have to start taking positive, calculated risks. Even if you are risk-averse, you may still be affected by others who have taken ill-advised risks. Just ask the US taxpayers who had to bear the cost of the 2008 financial crisis. Until that crisis hit, regulators were unaware that they did not fully understand the risks that banks were running. So whether you like it or not, we all have to live with risk, which means that we might as well adopt a positive attitude towards it. Risk is not something that we can avoid but something that we need to understand, identify, analyse and manage. In today’s fast-evolving financial markets in which numerous new financial products are introduced every year, it is essential that we fully understand the risk inherent to every transaction. I am delighted to be able to share my 30 years of trading experience, during which the financial crisis occurred. It is important to learn from mistakes, and I firmly believe that the world will not be safe until we have a thorough understanding of risk.

Sandy Lam (class of 2019)

Data and Information Management, HSBC Insurance Asia Limited

A year after receiving my Bachelor’s degree in data analysis and finance, I decided to embark on postgraduate studies of risk management alongside my full-time work to deepen my knowledge of statistics, finance and risk management.

With its diverse coverage, the MSc in RMSC gave me valuable experience of analysing and solving practical problems by utilising what I had learned, such as building an investment portfolio, conducting risk assessment and applying statistical theories in real-life situations. I particularly enjoyed exchanging ideas with professors after classes and with practitioners during seminars and special topic sessions.

Alongside my postgraduate studies, I worked in the field of data management in the banking industry. My studies supported my work by enhancing my understanding of the data requests I received from the risk department. After I finished studying, my passion for risk management inspired me to further advance my career by joining another major area of financial services, insurance. The MSc in RMSC was invaluable to my career development and heightened my enthusiasm for discovering, analysing and solving business challenges.

Calvin Yeung (class of 2022)

PhD studies in Informatics, Nagoya University

The MSc in RMDA programme has given me a thorough understanding of the subject. Despite my prior knowledge of risk management and statistics, this programme significantly enriched my understanding. With various courses available, I can select courses that suit my abilities and interests. Furthermore, the programming and data science knowledge I have acquired along the way will benefit my future machine learning research.

In my experience, the professors, teaching assistants and staff are keen to assist their students. Additionally, with a flexible arrangement, the needs of students and challenges under the pandemic were dealt with effectively and efficiently.

Ivy Qin (class of 2021)

Business Analyst, NumeriX LLC

I currently work for a Fintech company, where my job needs me to dig into different models and their applications in financial derivatives. The courses in the programme helped me a lot in exploring other models and methods in the industry. For example, RMSC5101 (Statistical Methods in Risk Management and Finance) and RMSC5102 (Simulation Techniques in Risk Management and Finance) helped me to learn simulation techniques and methodologies. RMSC5002 (Principles of Risk Management) and RMSC5003 (Risk Measures) improved my understanding of real-world risk-controlling principles and tools. Group-based projects also built and strengthened the relationships between classmates. Professors and staff are helpful and kind. The learning atmosphere definitely makes this programme enjoyable.

Company Visits

Bloomberg L.P. Hong Kong Office

Natixis

Census and Statistics Department, HKSAR Government

Aaron Siu (class of 2023)

The Bank of East Asia

Before enrolling in the MSc in Risk Management Science and Data Analytics programme, I had no experience in risk management. However, through the courses and practical exercises, I was able to develop a solid foundation in stochastic calculus, statistical analysis, and risk modelling. The programme not only provided me with theoretical knowledge but also equipped me with practical programming skills applicable in the risk management field, as well as a chance to meet and exchange ideas with practitioners and students from diverse backgrounds. Upon graduating, I have been able to apply my newfound expertise in the banking industry to effectively identify, assess and manage market risks.

Mars Tsang (class of 2023)

Nanyang Commercial Bank

As an old English saying goes, “Where there’s a will, there’s a way”. Strongly desiring to build my career in market risk, the first thing I needed to do was find a way to become market-ready. To nurture my skill sets in risk management and industry practice, I browsed the websites of numerous Master’s degrees and advanced diplomas and settled on RMDA as my first pick. Even now, I am so glad of making this wise choice.

One of the best things about the programme is the curriculum design. The RMDA programme provides students with all-round knowledge and skills as risk management professionals, ranging from quantitative skills and statistical concepts, through state-of-the-art programming applications in the industry, to regulatory and compliance requirements and practical experience sharing.

Apart from these, the course also offers activities such as visits to companies, workshops, guest lectures, and job opening referrals, which keep us connected with the market, experts, alumni, and other students too.

Most importantly, the professors and staff members are willing to offer their help to address students’ concerns in both academic and other matters. Their kind assistance allowed me to understand the course content thoroughly and to have an enjoyable time throughout my studies.

Thanks to all the well-designed training given by the programme, and the solid foundation in risk management, despite having no relevant experience I succeeded in my job interview. I am now just getting started on my path to being a professional risk management expert.

So, if you are looking for a career change, I believe the RMDA programme could be a great start for you too.

Alumni Gathering and the Alumni Association of the Department of Statistics (STAAA)

The Department of Statistics provides state-of-the-art computing facilities for teaching and research purposes.

Computer Laboratory

Common application software such as Microsoft 365/Office 2016 Professional Plus, MATLAB, R, SAS and IBM SPSS Statistics are installed on all PCs.

Bloomberg Terminals

Bloomberg Terminal provides real-time financial data and news from around the world. Tutorials on Bloomberg Terminal were offered to students.

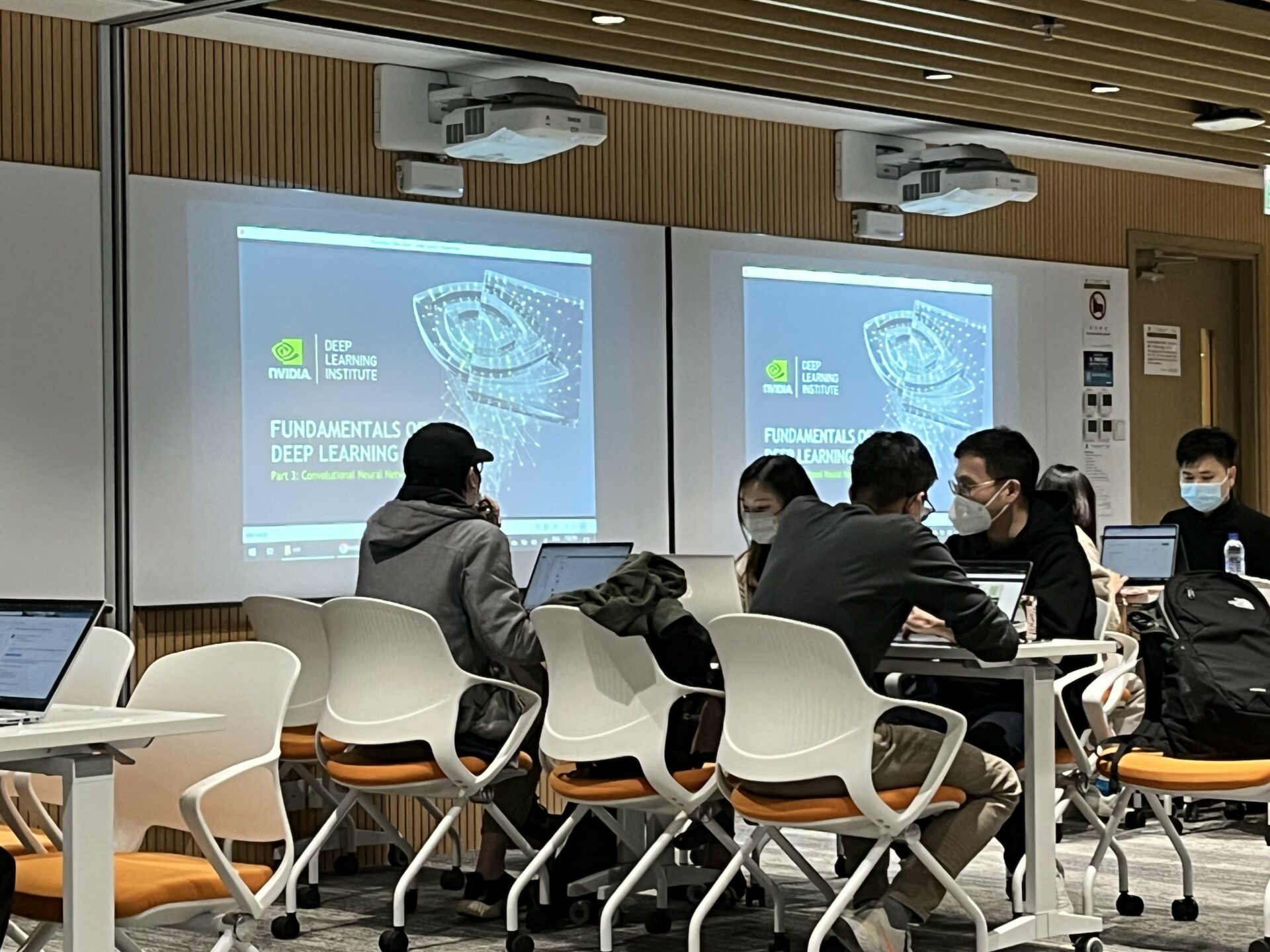

Collaboration with NVIDIA Deep Learning Institute (DLI)

NVIDIA workshops were organized and students had a chance to apply a wide variety of GPU‐accelerated machine learning algorithms. Participants who pass the assessment would receive an electronic NVIDIA DLI certificate to recognize their subject matter competency and support professional career growth.

Graduation Ceremony

FAQS

PROSPECTIVE APPLICANTS

The applicant shall

- have a Bachelor’s degree with second class honours or above in business, science, finance, economics, engineering or related disciplines;

- have fulfilled the University’s minimum English language requirements (please visit the link for details); and

- preferably (not compulsorily) possess knowledge of business, economics and/or finance.

We expect candidates to have a general background in mathematics and statistics. In particular, we expect them to be familiar with calculus, linear algebra, probability and statistical inference at the junior undergraduate level. Proficiency in computer programming is a plus.

You have fulfilled the English language requirement by obtaining a degree from a university in Hong Kong or a degree in which the medium of instruction was English. A score report of an English Language test is not required. You may, however, choose to provide your score report as supplementary information.

The GRE is not required, but you may choose to submit the report as supplementary information.

The MSc in Risk Management Science programme was launched in 2003 and is the pioneer in risk management education in Hong Kong. The programme was renamed MSc in Risk Management Science and Data Analytics in 2021-22 to reflect the new elements of the evolving field of data analytics.

You may amend your information in the application system. However, you will not be able to do so after a certain point in the application stage. If you cannot make the amendments on your own, please email us (rmda@cuhk.edu.hk) and provide the following information:

- Name

- Programme applied

- Application number

- Identity document number

- Information to be amended

Yes, two confidential recommendation letters are compulsory. However, we do not have specific requirements for the referees. They can be academic or non-academic such as supervisors and colleagues at the workplace.

You should submit the information of your referees including their email addresses in the application system. The system will send an invitation email to your referees at 5:00 am HKT the following day. Your referees may use the link and login information in the emails to complete and submit the recommendation letter. You may check the submission status in the application system, but you will not be able to access the confidential recommendation letter.

Please contact us via email if your referees cannot submit the letters through the application system.

Applicants may upload scanned copies of the academic transcripts with an official stamp at the application stage. Official transcripts and hard copies of supporting documents are NOT required at this stage. We will contact applicants for any official documents required.

Yes, electronic official transcripts are accepted (if so required), and you may arrange for submission to rmda@cuhk.edu.hk.

It takes around eight weeks for the Immigration Department of the HKSAR Government to process a student visa application. Non-local students are advised to submit their visa applications with all documents required (link) as soon as possible and within three weeks from the issuance of the admission offer. Non-local students unable to present a valid visa at the time of registration will not be allowed to register.

Full-time non-local students of the MSc in Risk Management Science and Data Analytics programme are usually issued No-Objection Letters (NOL) when the Immigration Department approves their student Visa applications. They are allowed to take up part-time employment, subject to the stipulations of the NOL.

Applications are reviewed on a rolling basis. Shortlisted applicants will receive an interview invitation via email or phone.

We do not send individual notifications. Unsuccessful applicants may check their status on the application system in July.

CURRENT STUDENTS

You should sign the “Statement of Consent” before starting the CEF course. Eligible students can submit an application form for account opening and fee reimbursement upon successfully completing the CEF course. You may also refer to the CEF website (link) for more information.

Please refer to the Finance Office website (link) for this information.

Students who passed FRM Part 1 Exam are eligible for exemption of core course RMSC5002 Principles of Risk Management. Only the course but not the units are exempted. Students who are exempted RMSC5002 must complete another 3-unit course to fulfil the graduation requirements.